🗓️ 2.07.2025

35+ Must-Know Social Media Statistics 2025 for Growth & Engagement

🕒 22 min read 🧑 by Richard Williams

Table of Contents

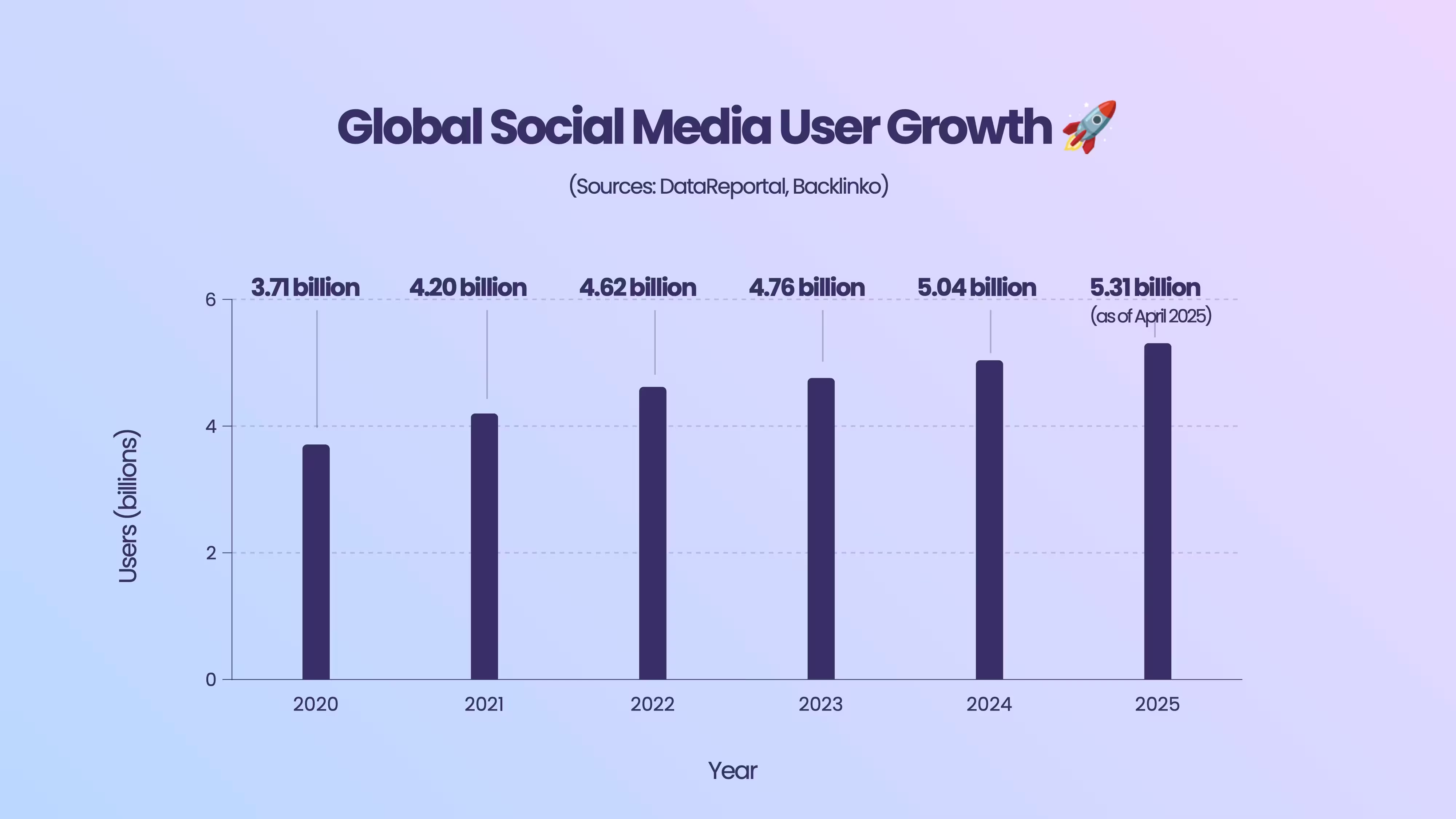

Social media in 2025 has evolved into one of the most influential forces in our daily lives: shaping how we communicate, discover content, and make decisions online. With over 5.31 billion users globally, social platforms now influence everything from daily conversations to billion-dollar business strategies. Whether you’re a marketer, brand builder, or curious strategist, understanding the latest social media statistics for 2025 is essential to stay ahead. In this report, we’ve compiled 35 must-know insights that reveal how platforms like Facebook, TikTok, Instagram, and YouTube are driving audience growth, engagement, and digital innovation worldwide.

Global Social Media Overview in 2025

As of April 2025, the global social media ecosystem has surpassed a new milestone: 5.31 billion users, representing 64.7% of the world’s total population (DataReportal, 2025). Among internet users, 94.2% use social platforms monthly, making social networking a near-universal digital activity.

In just the past 12 months, the social media audience grew by 241 million users, a 4.7% annual increase – equivalent to about 7.6 new users every second (DataReportal, 2025). While adoption in developed markets has plateaued, most of this growth now comes from regions with rising internet connectivity like Sub-Saharan Africa and South Asia.

Multi-Platform Usage & Engagement

Modern users don’t rely on just one platform. In fact, the average person is now active on 6.86 social media platforms each month. From professional networking on LinkedIn to entertainment on TikTok and updates on Facebook, platform variety reflects diverse usage needs.

Time-wise, people spend an average of 18 hours and 41 minutes weekly on social platforms-about 2 hours and 40 minutes daily. This consumption occurs in short bursts throughout the day, mainly on mobile. Unsurprisingly, over 98% of Facebook users and around 90% of YouTube viewers access these platforms via smartphones.

For deeper insights into how to expand your reach across multiple platforms, explore our in-depth guide on social media audience growth.

Platform by Platform Breakdown

Facebook Statistics 2025

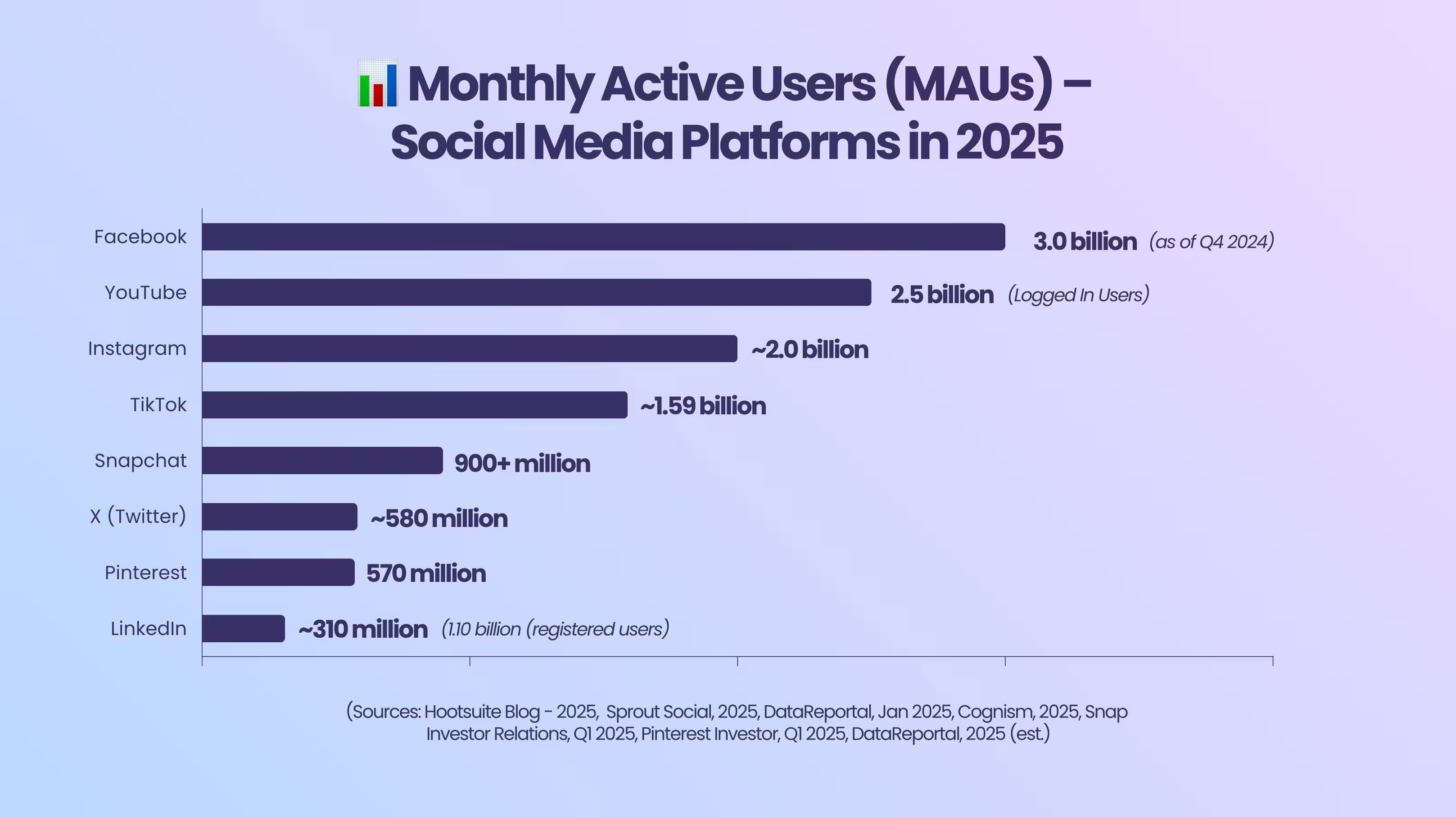

- Monthly Active Users (MAUs): Facebook remains the most widely used social network in the world, with over 3.0 billion monthly active users as of Q4 2024—representing nearly 38% of the global population. This enormous reach reinforces Facebook’s continued dominance, especially in regions like India, the U.S., and Southeast Asia.

- Daily Active Users (DAUs): On average, 2.11 billion users log in daily, meaning 69% of Facebook’s monthly users are engaging with the platform every day. While daily growth is stabilising, engagement remains remarkably strong given Facebook’s age and scale.

- Demographics: Facebook’s user base continues to skew older compared to platforms like TikTok or Snapchat. It is especially popular among Millennials and Gen X. The platform’s largest user populations are in India, the United States, and Indonesia, each boasting over 175 million active users.

- Content Trends: Facebook has adapted to evolving user habits by focusing on Reels (short videos), video content, Groups, and Marketplace listings. Video posts, in particular, achieve higher engagement than static images or text updates, while niche community Groups drive long-session interactions.

- Advertising Reach & Revenue: With an advertising reach of 2.28 billion users globally (excluding China), Facebook remains an ad powerhouse. In Q4 2024 alone, its parent company Meta reported $46.8 billion in ad revenue, solidifying its position as the top destination for marketers seeking scale and precise targeting.

Instagram Statistics 2025

- Monthly Active Users (MAUs): Instagram continues to be one of the world’s most influential visual platforms, with an estimated 2 billion monthly active users globally as of early 2025. While Meta doesn’t release MAU updates as frequently as it does for Facebook, independent analytics consistently place Instagram as the third most-used social media platform after Facebook and YouTube.

- User Engagement: Instagram users are highly engaged, spending an average of 32.4 minutes per day on the platform (Android users). This translates to more than 16 hours per month, driven by content formats like Stories and Reels. In fact, over 500 million accounts use Instagram Stories every single day.

- Demographics: Instagram’s user base is dominated by the 18–34 age group, making it particularly popular among Millennials and older Gen Z. It also has a slight gender skew, with approximately 52% of its global audience identifying as female. Usage remains high in the U.S., where over 170 million people use Instagram, as well as in India, Brazil, and Indonesia, each boasting 100M+ users.

- Content Trends: Instagram’s shift toward short-form video continues to define user experience. Reels, introduced as a TikTok competitor, now see billions of views daily and are prioritized in the algorithm. Users also heavily engage with shoppable posts and live shopping events, highlighting Instagram’s dual identity as a discovery and commerce platform.

TikTok Statistics 2025

- Monthly Active Users (MAUs): TikTok reports approximately 1.59 billion active users as of January 2025, covering a sizeable portion of the internet-connected population

- User Base: TikTok has been downloaded over 3 billion times since its launch in 2016, with approximately 1.59 billion global users as of January 2025. This figure, derived from advertising reach estimates, likely underrepresents its total active audience. It now ranks among the top five most-used social platforms globally and is the #1 app for Gen-Z in many markets.

- Time Spent & Engagement: TikTok sets the benchmark for user engagement across all platforms. Users spend an average of ~35 hours per month on the app, often in short bursts throughout the day. The typical user opens the app approximately 360 times per month – around 12 sessions per day. This translates into highly habitual usage, driven by TikTok’s addictive algorithm and endless stream of short-form video.

- Demographics: Roughly 63% of TikTok’s global users are under 30, with a particularly strong presence among teens and early-20s users. The platform’s youth-centric user base makes it a prime channel for brands targeting Gen-Z and young Millennials, especially in sectors like fashion, entertainment, and lifestyle.

- Advertising & Revenue: TikTok’s advertising reach now covers 884 million 18+ users, and its ad business is expanding rapidly. In 2024, TikTok generated an estimated $10 billion in ad revenue, and this number is expected to grow significantly as brands increase their short-form video budgets.

- Cultural Impact & Trends: Beyond user stats, TikTok drives real-world trends—from viral dance challenges to the resurgence of hit songs. It has also pushed the entire industry toward short, vertical video formats, influencing competitors like Instagram Reels and YouTube Shorts.

YouTube Statistics 2025

- Monthly Active Users (MAUs): YouTube boasts approximately 2.5 billion monthly logged-in users worldwide as of 2025, making it the second-most-used social platform globally, just behind Facebook. Since many people also use YouTube without logging in, its true reach is even higher.

- Viewing Time: YouTube sees unparalleled engagement in terms of content consumption. Users spend an average of 48.7 minutes per day on the platform, with a collective 1 billion hours of video watched daily. Notably, much of this watch time is shifting to smart TVs—indicating YouTube’s growing role in replacing traditional TV viewing.

- Mobile & TV Usage: While around 90% of YouTube views still come from mobile devices, usage on connected TVs is the fastest-growing segment. In fact, in 2024, over 1 billion hours of video were streamed daily just from TV devices – showing YouTube’s dominance in the living room.

- Creator Economy: YouTube supports a thriving ecosystem of content creators. As of 2025, there are more than 114 million active YouTube channels globally, and the platform paid out over $15 billion to creators in 2024 through ad revenue sharing, memberships, and other monetisation tools.

- Content Variety: From tutorials and music videos to podcasts and Shorts, YouTube offers one of the broadest content libraries online. Its ability to cater to both long-form and short-form preferences has helped it maintain relevance across generations.

LinkedIn Statistics 2025

Total Registered Members: As of January 2025, LinkedIn has surpassed 1.1 billion registered members globally. This milestone reflects steady growth, especially in emerging professional markets and among job seekers during economic shifts. Unlike platforms that report monthly active users, LinkedIn’s figures are based on total accounts.

- Daily Active Users (DAUs): While not officially disclosed, industry estimates suggest LinkedIn has approximately 134.5 million daily active users. However, most users engage with the platform on a weekly basis, often checking in for networking, job alerts, or industry updates.

- Ad Reach & Growth: LinkedIn’s advertising reach now exceeds 1.2 billion users, with a +17.1% year-over-year growth in 2024, one of the strongest among major platforms. This reflects not just new user acquisition but improved ad tracking and increased usage frequency among professionals.

- Revenue: LinkedIn generated roughly $15 billion in revenue in 2024, fuelled by a combination of advertising products, premium memberships, and its powerful recruitment tools for enterprises.

- Content & Usage Trends: Unlike entertainment platforms, LinkedIn’s engagement revolves around career development, thought leadership, and industry news. The platform saw record levels of content sharing in 2024, driven in part by post-pandemic job transitions and the rise of the “solopreneur” economy.

- Geographic Reach: The United States remains LinkedIn’s largest market with about 234 million members, followed by India (~148 million) and China (~57 million). Europe also represents a significant user base, with over 300 million European members.

X (Twitter) Statistics 2025

- Monthly Active Users (MAUs): X (formerly Twitter) is estimated to have between 560–600 million monthly active users globally in early 2025. Since the platform stopped publishing official user data post-privatisation in 2022, these figures come from third-party ad reach estimates and usage analytics.

- Daily Active Users (DAUs): The last reported figure for monetisable daily active users (mDAUs) was 237.8 million back in Q2 2022. Current external estimates suggest daily activity has climbed to around 250 million, despite fluctuations due to recent platform changes and rebranding.

- Time Spent: X users spend significantly less time on the platform compared to visual-first apps. The average user spends only 11 minutes per day, totalling about 3.7 hours per month. This reflects Twitter’s real-time, dip-in-dip-out usage pattern.

- Demographics: The platform skews male, with approximately 61% of users identifying as male. Its core demographic lies in the 25-49 age range, making it popular with professionals, journalists, and politically active users. The U.S. remains the top market (~95M users), followed by Japan (~60M) and India (~25M).

- Content Volume: Around 500 million tweets are posted daily, but engagement is increasingly concentrated: a small group of highly active users generates the majority of content.

- Strategic Shifts: Under the X rebrand and new ownership, the platform is moving toward longer posts, paid subscriptions (like X Premium), and expanded video capabilities. While it faces user churn in Western markets, it continues to grow modestly in Asia, the Middle East, and Africa.

Snapchat Statistics 2025

- Monthly Active Users (MAUs): Over 900 million as of Q1 2025, with continued global growth, especially in India and Europe.

- Daily Active Users (DAUs): Reached 460 million, up 9% year-over-year—showing strong habitual use, particularly among younger demographics.

- Demographics: About 60% of users are under 25, and Snapchat reaches 90% of 13-24 year-olds in the US and UK. Gender split is fairly balanced, with a slight lean toward female users.

- Engagement: Users open the app 30+ times per day, with over 5 billion Snaps created daily. AR Lenses and messaging remain key drivers of daily engagement.

- Content Trends: Snapchat’s Spotlight (short-form video feed) has doubled its viewership year-over-year, competing with Reels and TikToks. Their AI chatbot “My AI” also garners millions of daily interactions.

- Revenue: Although Snapchat’s ARPU (average revenue per user) trails competitors, its ad reach now exceeds 850 million, and its ad tools continue to expand into AR and e-commerce.

Pinterest Statistics 2025

- Monthly Active Users (MAUs): As of Q1 2025, Pinterest has reached an all-time high of 570 million monthly active users, up from 498 million just a year earlier—an impressive 11% year-over-year growth. This resurgence follows a brief dip in 2021 and reflects Pinterest’s successful pivot toward shopping and visual discovery.

- Demographics: Pinterest remains one of the most female-dominated platforms, with around 70% of users identifying as women. It has also secured strong engagement among Millennials and Gen Z, especially those seeking inspiration for fashion, home decor, wellness, travel, and event planning.

- User Behavior & Intent: Unlike many other social platforms that revolve around entertainment, Pinterest is used primarily for visual discovery and idea curation. Around 60% of users say they use Pinterest to find new products, which makes it especially attractive to brands looking to reach users with high commercial intent.

- Content Trends: The platform’s “Idea Pins” (short-form vertical content) and curated boards continue to gain traction. Pinterest’s algorithm prioritizes positivity, which supports its reputation as a “feel-good” platform. It consistently ranks as one of the top platforms for user well-being and low negativity in surveys.

- Ad Revenue & Commerce: Pinterest generated $2.8 billion in ad revenue in 2024, thanks to its commerce-friendly audience and ad formats. The company continues to invest in shoppable Pins, AR try-on tools, and integrated checkout experiences, making it a strong player in the growing social commerce market.

- Top Markets: While the United States remains Pinterest’s largest market (~90 million users), international adoption is rising fast. Countries like Brazil (~39M), Mexico (~25M), Germany (~19M), and France (~17M) now represent a significant portion of the global user base.

Advertising & Revenue Trends

- Global Ad Spend: In 2025, global social media advertising spend is projected to reach a staggering $276.7 billion, solidifying social platforms as one of the top channels for digital marketing investments. This figure reflects continued growth fuelled by improved ad targeting, data-driven optimisation, and increased reliance on social for e-commerce and branding.

- Mobile-First Spending: A full 83% of all social ad spend now occurs on mobile devices, aligning with the mobile-dominant usage behavior across all major platforms. Whether it’s in-feed video, Stories, Reels, or native shopping experiences, advertisers are prioritising mobile-friendly formats to match user behaviour and maximise ROI.

- Meta’s Continued Dominance: Meta (formerly Facebook Inc.) still commands the lion’s share of global social ad revenue. Between Facebook’s 2.28 billion ad reach and Instagram’s performance with shoppable content, Meta offers unmatched scale and sophisticated targeting options. In Q4 2024 alone, Meta reported $46.8 billion in ad revenue, driven by its powerful algorithmic placements and advertiser tools.

- Fast-Rising Contenders – TikTok & Pinterest:

- TikTok has seen explosive growth in advertising, with $10 billion in ad revenue in 2024, powered by high engagement and short-form video performance. Brands are embracing its creator-driven content ecosystem and dynamic ad formats like Spark Ads and TikTok Shop placements.

- Pinterest, meanwhile, is a rising star in social commerce. With $2.8 billion in ad revenue in 2024, it’s become a favourite for product discovery and intent-driven advertising. Shoppable Pins, AR try-on tools, and its “visual search” features are helping advertisers drive meaningful conversions.

- ROI & Performance Trends: Platforms that blend content discovery with commerce—like Instagram, TikTok, and Pinterest—are delivering the highest return on ad spend (ROAS). Marketers are shifting budget toward video, personalised creatives, and “moment-based” ad strategies that match users’ interests and intent in real time.

Content & Format Trends in 2025

Short-Form Video Takes Center Stage

Short-form video has become the undisputed king of social media content. In 2025, approximately 78% of consumers say they prefer discovering new products through short videos like TikToks and Instagram Reels over traditional text-based posts . The overwhelming success of TikTok has catalysed this trend, with competitors such as Instagram (Reels), YouTube (Shorts), and Snapchat (Spotlight) scrambling to capture similar engagement levels.

Platforms favor this format in their algorithms because of its ability to keep users engaged. Marketers have caught on-93% plan to maintain or increase spending on short-form video in 2025. This format allows for quick storytelling, viral challenges, and visually rich content that resonates with Gen-Z and Millennial users especially.

The Rise of the Creator Economy

The global influencer marketing industry is projected to exceed $30 billion in 2025-a threefold increase from its 2020 value of $10B. Platforms are rolling out more monetisation features to retain talent, such as ad-revenue sharing (YouTube), branded content marketplaces (TikTok Creator Marketplace), and fan subscriptions (Instagram Subscriptions, Twitter Blue).

Surveys show over 80% of marketers find influencer marketing effective and plan to expand their budget in this area. The creator economy is also being reshaped by AI tools, with 66% of marketers using AI to improve campaign performance, influencer discovery, and content optimisation.

Social Commerce Goes Mainstream

Social media is now a primary shopping channel. In 2025, social commerce is expected to hit $1.2 trillion globally, accounting for 17% of all e-commerce sales. Instagram and Facebook Shops, TikTok Shop, and Pinterest’s shoppable Pins all enable consumers to buy without leaving the app.

Social commerce thrives in visually rich categories like fashion, home décor, and beauty. Platforms are also developing seamless checkouts and AR try-on tools to reduce friction. The ability to link product discovery directly to purchase is revolutionising both e-commerce and digital advertising.

Emerging Technologies Reshaping the Landscape

While social audio (like Clubhouse) has faded, AR and AI-powered features are booming. Snapchat has served trillions of AR lens impressions, and TikTok and Instagram now integrate popular AI filters and avatars into everyday use.

Meta’s virtual reality efforts with Horizon Worlds and immersive metaverse projects remain in early adoption stages. Still, AI-generated content, personalized feeds, and interactive formats are setting the tone for what’s next. Many platforms are also adding more private sharing tools-like Instagram’s Close Friends or ephemeral content-to meet the rising demand for more personal, intimate digital interactions.

Demographic Insights & Regional Highlights

Gender & Age Breakdown

| Platform | Gender Breakdown | Core Age Group |

|---|---|---|

| Skews slightly female (52%) | 18–34 | |

| TikTok | ~63% of users under 30 | Strong among teens & young adults |

| Snapchat | Fairly balanced, slight female lean | 90% of 13–24 year-olds in US/UK |

| ~70% female | Millennials & Gen Z | |

| X (Twitter) | Skews male (~61%) | 25–49 |

Top Countries by Platform

| Platform | Top Country | Other Major Markets |

|---|---|---|

| India | USA, Indonesia | |

| USA | India, Brazil, Indonesia | |

| TikTok | USA | China (via Douyin), Indonesia, Brazil |

| YouTube | Global | Universally strong |

| USA | India, China | |

| USA | Brazil, Mexico, Germany | |

| Snapchat | USA | India, UK, France |

| X | USA | Japan, India |

These demographics highlight the global diversity of social platforms and provide crucial insights for marketers looking to localise their content and optimise campaigns.

Implications for Marketers & Businesses

In 2025, social media is no longer just a branding tool-it’s a full-funnel marketing ecosystem.

- Ad Targeting: With precision tools available on Meta platforms and LinkedIn, marketers can reach ultra-specific audiences by interests, location, behaviour, and even job titles.

- Influencer Campaigns: Collaborations with creators are now standard. Authenticity and micro-influencers often outperform traditional ads in trust and engagement.

- Social Commerce Integration: Brands must design their social content for conversion. This means clickable posts, shoppable videos, and interactive AR experiences.

The most successful marketers are those adapting quickly to short-form video trends, embracing AI for content generation and personalisation, and investing in performance-driven campaigns across platforms.

Not sure where to start? If you’re looking for expert guidance, check out our guide to the Top 5 Social Media Marketing Agencies in the UK to find the right partner for your goals.

What to Expect in Social Media 2026 and Beyond

Looking ahead, we expect:

- Continued growth in emerging markets as internet access expands

- Greater integration of AI and machine learning for personalised content

- Stronger privacy and regulation pressures, especially on ad targeting

- Virtual and augmented reality features growing slowly but steadily

- Deeper in-app commerce – potentially rivaling traditional e-commerce platforms

The future of social media is immersive, transactional, and creator-driven. Businesses and creators alike must innovate to remain visible in an ever-evolving feed.

If you’re looking to elevate your brand’s strategy and turn these insights into action, explore how our Social Media Marketing services can help you grow faster, smarter, and with measurable impact.

Conclusion & Key Takeaways

Social media in 2025 is an unstoppable force shaping communication, commerce, entertainment, and culture. With over 5.31 billion users, it continues to be the most influential digital space. Platforms like TikTok, Instagram, and YouTube are redefining engagement through short-form video, while Facebook and LinkedIn remain stalwarts of reach and professional networking.

As businesses and creators face evolving user expectations, embracing mobile-first strategies, AI-powered personalisation, and commerce-ready content will be essential. Whether you’re marketing a brand or building an audience, understanding these key statistics can help shape a winning strategy in the fast-moving digital world.

Frequently Asked Questions (FAQs)

Facebook remains the largest with 3.0 billion monthly active users, followed by YouTube and Instagram.

Users average 18 hours and 41 minutes per week, or about 2 hours and 40 minutes per day.

TikTok leads in engagement with users spending ~35 hours/month and opening the app 360+ times/month.

Approximately 94.2% of internet users worldwide use social media every month.

Projected to reach $276.7 billion, with 83% of spend happening on mobile ads.

Social commerce involves purchases made directly within social apps. It’s estimated at $1.2 trillion globally, making up 17% of all e-commerce.

TikTok and Pinterest are among the fastest-growing platforms, with TikTok expanding rapidly in Asia and Pinterest seeing double-digit year-over-year growth globally.

Globally, the 18–34 age group is the most active on platforms like Instagram, TikTok, and Snapchat, while platforms like Facebook see stronger usage among users aged 25–44.

On average, users actively engage with about 6.86 different social media platforms each month.

Love a good stat? Here’s else everything you need to know for 2025

- 📈 WhatsApp Statistics 2026: Users, Engagement & WhatsApp Business

- 📈 Podcast Statistics 2026: Growth, Spend & Demographics

- 📈 YouTube Statistics 2026: Shorts, Subscribers & Revenue

- 📈 TikTok Statistics 2026: Global & UK Insights for Marketers

- 📈 Influencer Marketing Statistics 2026: UK Trends, Spend & Compliance

- 📈 Reddit Statistics 2026: Users, Subreddits & Revenue

- 📈 Spotify Statistics 2026: User Demographics, Daily Usage & Revenue

- 📈 ChatGPT Statistics 2026: Sessions, Subscribers & Revenue

- 📈 YouGov Brand Rankings 2026: The World’s Most Loved Brands, Revealed

- 📈 Pinterest Statistics 2025: UK & Global Insights for Marketers

- 📈 Facebook Statistics 2025: UK & Global Insights for Marketers

- 📈 Snapchat Statistics 2025: Key UK & Global Insights for Marketers

- 📈 Instagram Statistics 2025: UK & Global Insights for Marketers

- 📈 LinkedIn Statistics 2025: What UK Marketers Need to Know

- 📈 35+ Must-Know Branding Statistics 2025 for Growth & Engagement

- 📈 35+ Must-Know Social Media Statistics 2025 for Growth & Engagement